There are a couple of times when people come to talk to Bob Holland of Centralia General Agencies about medical coverage for seniors – when people are turning 65 and need to know their options, or when the adult kids of seniors need to help their parents navigate the Medicare maze.

“Many ‘kids’ in their 50’s haven’t really thought about Medicare for themselves, let alone their parents,” explains Holland. “It seems so far off in the future.”

Holland says that many people think Medicare and Social Security are the same, but in reality it is two separate agencies that interface with each other.

To clear up some confusion around Medicare, let’s start by defining what each section of Medicare means.

Part A

Part A is hospital coverage and there is no cost sharing for services approved by Medicare. Part A covers 80% of everything that can occur in a hospital such as the overnight stay, medications and all the medical tests.

Part B

Part B covers service outside of the hospital, such as visiting a doctor for an illness. This is where it interfaces with Social Security. Part B costs $134.00 per month and is deducted from a person’s social security check. “Sometime people get upset thinking that once they turn 65 everything is free, but that’s not the case,” explains Holland.

Something else that could be a surprise is that Part B also only covers about 80% of the costs. There are deductibles and co-pays, much like an employer-sponsored group medical plan. Plan B does not cover experimental procedures.

Part D

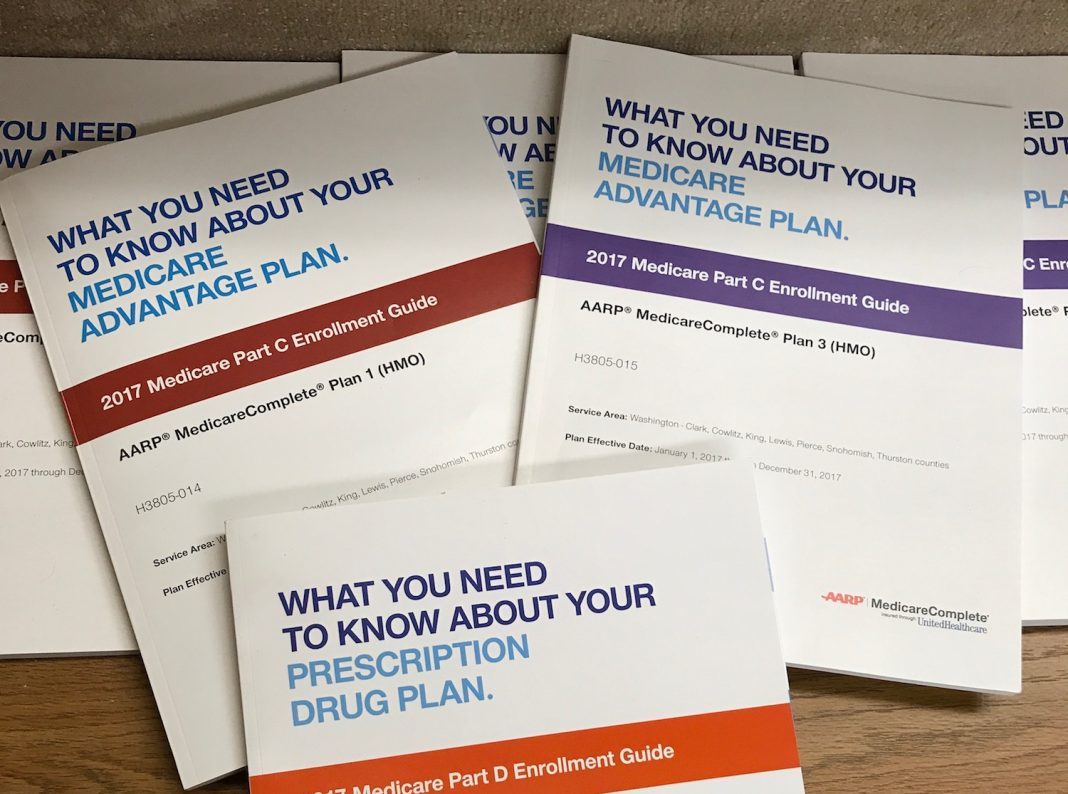

Medicare Part D covers drugs. Associating the “D” with “drugs” is helpful. “Part D is private insurance mandated by the government to provide drug coverage for seniors,” says Holland. Again, however, it does not cover 100% and may have deductibles and cost sharing, including the coverage gap or “donut hole”.

“Seniors often seek some assistance in shopping to get the best bang for their buck,” explains Holland.

Gap Insurance

You may have heard about private Medi-Gap Insurance in the past. This older and time tested model may often cover those co-pays and deductibles that Medicare coverages A and B left remain unpaid. These plans are available but then newer fangled Plan C (Advantage Plans) which hit the market about 12 years ago, can be a more economical and convenient solution

Plan C

Now we step backwards in the alphabet to look at hybrid models. Yes, it would have made more sense to most of us if the government just picked another letter down the list instead of going backwards, but Part C is what we have.

Medicare wanted insurance companies to come up with a one-size-fits-all plan that integrates the government plans of A&B with the private plan, D. That way a person is covered in the hospital with Plan A, outside the hospital with Plan B and D with Plan C to help cover most of the difference in costs. This model can have no medical deductible except possibly for prescriptions, and lower co-pays for office visits and medications.

Choosing Your Plan

Now that we know the differences between all the plans, it’s time to find out how to choose the right plan for someone approaching retirement.

Plans selections vary by county. Currently, Lewis County has three Plan C choices, and six or more medigap plans. Medigap premiums are usually more costly. It often depends on the healthcare need of the individual applicant.

“It is these variables that a health insurance agent is trained in educating the consumer about and having those products available to offer our customers,” explains Holland. “We help match customer’s medical visit patterns with a plan so they don’t have to change doctors.”

When should you start looking? Holland says that federal rules say you can’t apply until you are 90 days away from the month you turn 65, or the date that you eligible for medicare disability.

However, he can start working with you 30-60 days ahead of that date to help review the options. For you “kids” planning with your parents, there is an open enrollment period starting October 15, and Holland can help you look over various options to choose the best fit. People can change plans every year if they like, or choose to stay with the one they have. “I’m also happy to impart my knowledge well before any deadlines,” he smiles. “Sometimes people ask if they can just have 20 minutes of my time to look at where they may be in a year or so.”

“If a senior is coming in to review their plans, it is always good if their “kids” (aka younger adult children) can come along with them and learn too. That adult child may simply want to come and talk to me about their own future plans, that’s fine as well. I’m happy to coach everyone,” smiles Holland.

Centralia General Agencies

209 W. Main St.

Centralia WA 98531

360-736-8283

Sponsored